Feb 3, 2013 | Social Security SSD/SSI |

Social Security Offices Around the Country Introduce Shorter Hours Beginning on November 19, 2012, the Social Security Administration will close field offices to the public 30 minutes early each day. For example, in Ohio that means that Ohio Social Security offices...

Dec 29, 2012 | Social Security SSD/SSI |

Social Security Disability Application Process Now Online If your disabling condition makes it hard for you to drive or arrange transportation to your local Social Security office, there is some good news from the Social Security Administration. You’re now able to...

Dec 2, 2012 | Social Security SSD/SSI |

Senate Committee Reveals Trouble with the Quality of ALJ Decisions A recent article in the Washington Times discussed the increasing stress that the Social Security Disability system is operating under and how that stress has led to troubling problems affecting...

Dec 2, 2012 | Social Security SSD/SSI |

Sleep Apnea Sleep apnea is a disorder characterized by moments during which a sleeping person is unable to move their respiratory muscles or maintain airflow through the nose and mouth. In short, this means a person stops breathing for short periods of time. Generally...

Nov 17, 2012 | Social Security SSD/SSI |

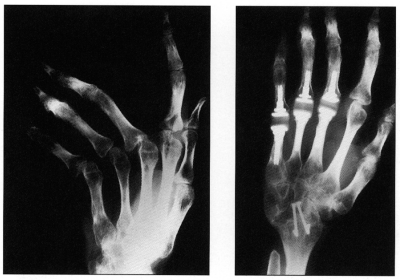

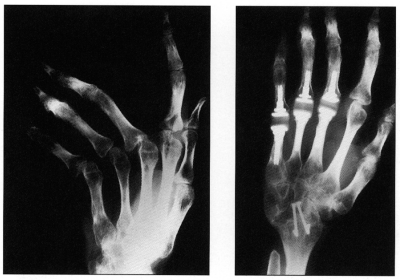

Rheumatoid Arthritis Rheumatoid arthritis is a disease that causes damage to joints, organs, and bodily systems due to inflammation of joint tissues. While inflammation is usually a response by a person’s immune system to disease or infection, the immune system of...

Recent Comments