Nov 11, 2012 | Social Security SSD/SSI |

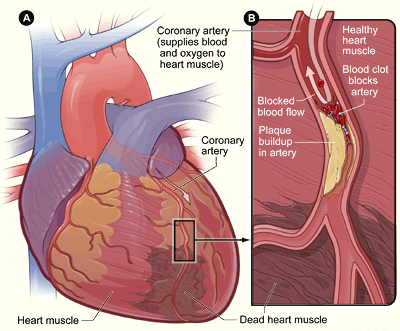

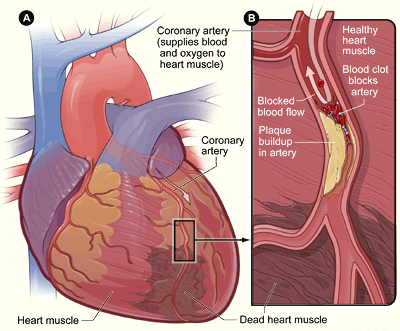

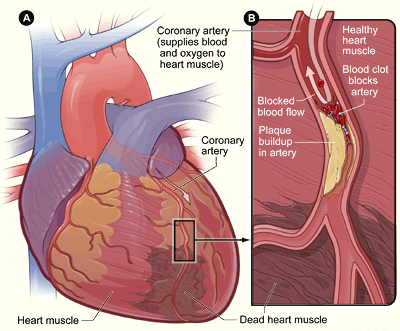

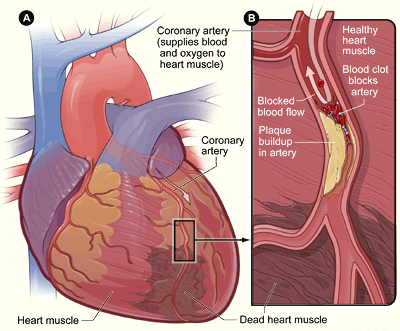

Chronic Heart Failure Chronic heart failure (CHF) is a potentially lethal condition where the heart cannot pump a sufficient amount of blood, which can then cause blood to accumulate in the vessels leading to the heart and can cause congestion or accumulation of fluid...

Recent Comments