Social Security Disability benefit overpayments discharged in personal bankruptcy

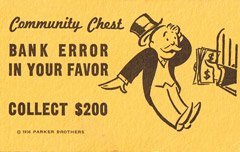

Many of our clients are currently receiving benefits from the Social Security Administration because they are permanently disabled. So, what if Social Security attorney, John T. Nicholson in Centerville, Ohio, won your Social Security Appeal in downtown Dayton, Ohio, and you got more money than you should have? That is called an overpayment, and the government may attempt to collect it.

Many of our clients are currently receiving benefits from the Social Security Administration because they are permanently disabled. So, what if Social Security attorney, John T. Nicholson in Centerville, Ohio, won your Social Security Appeal in downtown Dayton, Ohio, and you got more money than you should have? That is called an overpayment, and the government may attempt to collect it.

Filing for Chapter 7 bankruptcy or Chapter 13 bankruptcy will discharge your obligation to repay the government. The overpayment is treated the same as all other general unsecured debts.

There are some exceptions. You cannot discharge an obligation to repay fraudulently obtained benefits.

This is the same rule with most forms of government benefit overpayments, like Workers’ Compensation benefits (a.k.a. Workers Comp). If there was no fraud in obtaining the benefits, then you can file personal bankruptcy to discharge your obligation to repay the overpayment.

Call today for a free consultation (937) 432 – 9775.

This is great information for those looking at a large overpayment. Is there no downside to filing bankruptcy when you expect future benefits from the social security administration? Can it withhold future payments? And if they did, would that be a violation of any law?

Hello,

I am located in Canton, Ohio. I see on your site where you say that Worker’s Comp. over payments (no fraud involved) are dischargable in bankruptcy. We filed on an overpayment. My BK atty was not familiar with it being dischargable but humored me by including it. Now, my workers comp. atty is also not familar with it and WC is withholding from my working wage loss. Do you have a legal reference I can point my atty. to?

John,

Beleive it or not, a lawyer that makes “House Calls… or least phone calls” for lack of a better illustration.

Nopt to mention he called me ona Sunday night, about 7PM, on his off time to help me…

He went out of his called me, an even though he couldn’t represent me, he gave me “Solid Advice…”

5 stars…..