Blog

Will I lose my disability when I go to prison or jail?

How Will Prison Affect My Disability Benefits? When a person is facing incarceration there is surely a lot on their mind. If the person is receiving Social Security Disability benefits, one of the questions might be whether or not they can keep their disability...

Will my social security disability judge (ALJ) look at my Facebook account?

The Importance of Social Media in Social Security Disability Claims Before the advent of the Internet, investigators had a much harder job. Collecting information, verifying statements and making sure everything added up is a lot more difficult without the help of...

Can I get SSI benefits for Pain?

I Have Chronic Pain, Can I get Disability? If you suffer from chronic pain you understand just how variable the condition can be. For some the pain is continuous, for others it is intermittent, some suffer terribly while others live with less severe pain. Chronic pain...

What questions will the ALJ ask in my disability SSI / SSDI hearing?

What kind of questions will I be asked at my disability hearing? Many people are interested in knowing details about their disability hearing. For instance, how many and what kind of questions can you expect? Most hearings will be over in under an hour and some even...

Can I get SSI and still work?

Collecting SSI Disability While Working Part Time Many people mistakenly believe that if you receive Supplemental Security Income (SSI) disability benefits you have to be totally unable to work. That’s not the case and it is possible to be gainfully employed...

Can I get disability for my chronic fatigue syndrome?

Chronic Fatigue Syndrome & Social Security Disability According to information from the National Institutes of Health, chronic fatigue syndrome (CFS) is a condition that can cause severe and ongoing tiredness that cannot be improved by simply resting and that does...

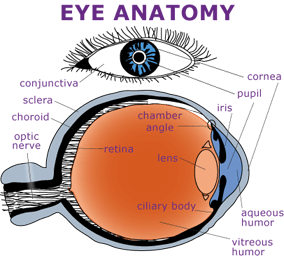

I am legally blind, can I receive disability benefits?

Requirement for receiving disability for Legal Blindness According to an April 2011 report from the American Academy of Ophthalmology, more than one million people in the United States over the age of 40 are legally blind. Most of you have heard the term “legally...

Which medical records are the best for winning my disability claim?

What kinds of medical records do you need for your disability claim? Before you can begin collecting disability benefits, the Social Security Administration requires that you prove that you are unable to work. The best evidence of this is, obviously, medical...

Can I work and get SSI disability at the same time?

Collecting Disability While On The Job Many people mistakenly believe that if you receive Supplemental Security Income (SSI) disability benefits you have to be totally unable to work. That is not the case and it is possible to be gainfully employed and still receive...

My disability claim was denied. What happens next?

My disability claim was denied. What happens next? If you have filed a claim for disability benefits and it was denied then you may be wondering what options you have for moving forward. Applying for disability can be very confusing for those not dealing with it on a...

Contact Us For A Free Consultation

If you have a personal injury, Social Security, or VA Benefit issue please contact the Law Offices of John T. Nicholson and schedule a free consultation today! Please Call us at 1-800-596-1533 or fill out our contact form by clicking the button below.

Free Case Evaluation

Free Case Evaluation

Law Offices of John T. Nicholson

Beavercreek

4461 Dayton Xenia Road

Dayton, OH 45432-1805

(937) 432-9775

Map & Directions

Columbus

1041 Dublin Rd #103

Columbus, OH 43215

(614) 384-5800

Map & Directions

Trotwood

2541 Shiloh Springs Road

Dayton, OH 45426

(937) 524-5922

Map & Directions

Kettering

5335 Far Hills Ave., Ste. 108

Kettering, OH 45429

(937) 524-5922

Map & Directions

Piqua

430 N Wayne St

Piqua, OH 45356

(937) 325-8500

Map & Directions

Springfield

150 N Limestone St #217

Springfield, OH 45501

(937) 325-8500

Map & Directions

Troy

22 N Market St

Troy, OH 45373

(937) 524-5922

Map & Directions

Mailing Address

P.O. Box 41450

Dayton, OH 45441

FAX: 1-800-801-1205

Beavercreek Office

4461 Dayton Xenia Road

Dayton, OH 45432-1805

(937) 432-9775

Map & Directions

Cincinnati Office

2021 Auburn Ave., Suite 105

Cincinnati, OH 45219

(513) 276-4677

Map & Directions

Columbus Office

1041 Dublin Rd #103

Columbus, OH 43215

(614) 384-5800

Map & Directions

Franklin Office

8 Stadia Drive

Franklin, OH 45005

(937) 432-9775

Map & Directions

Kettering Office

5335 Far Hills Ave., Ste. 108

Kettering, OH 45429

(937) 524-5922

Map & Directions

Piqua Office

430 N Wayne St

Piqua, OH 45356

(937) 325-8500

Map & Directions

Springfield Office

150 N Limestone St #217

Springfield, OH 45501

(937) 325-8500

Map & Directions

Trotwood Office

2541 Shiloh Springs Road

Dayton, OH 45426

(937) 524-5922

Map & Directions

Troy Office

22 N Market St

Troy, OH 45373

(937) 524-5922

Map & Directions

West Chester Office

7103 Cincinnati Columbus Rd

Cincinnati, OH 45069

(513) 276-4677

Map & Directions

Recent Comments