Aug 27, 2011 | Social Security SSD/SSI |

What are Social Security acquiescence rulings? Recently a bankruptcy attorney working at the Nicholson Law Center mentioned that she had been searching the internet for information about Social Security and had found an “acquiescence ruling.” Although the term...

Aug 23, 2011 | Social Security SSD/SSI |

Can I receive Social Security benefits while serving a prison sentence? A question that Social Security attorneys encounter from time to time is whether someone can receive Social Security benefits while serving a sentence in prison. The answer depends on the...

Aug 20, 2011 | Social Security SSD/SSI |

How much income can parents have before their children no longer qualify for Supplemental Security Income benefits? Disabled children can qualify for benefits under the Supplemental Security Income (“SSI”) program, which is administered by the Social Security...

Aug 20, 2011 | Social Security SSD/SSI |

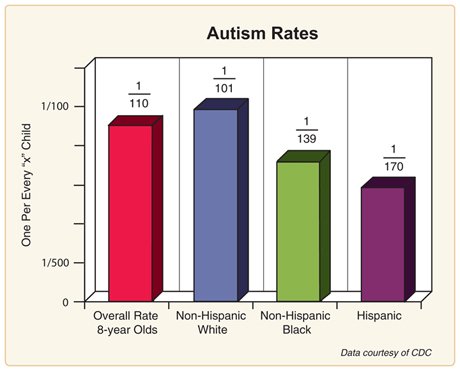

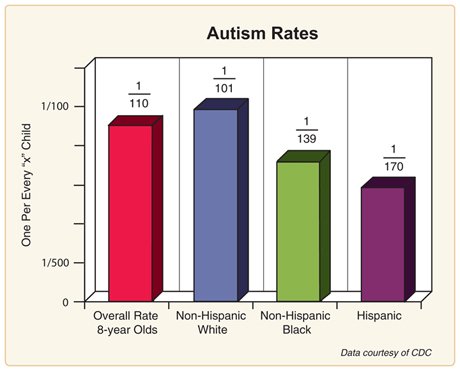

Can a child with autism receive Social Security disability benefits? The parents of an autistic child recently asked me whether their child could be eligible to receive Social Security disability benefits. Generally, autism qualifies as a disability for Social...

Aug 17, 2011 | Social Security SSD/SSI |

How can I afford to pay a social security disability lawyer? If your claim for Social Security disability benefits has been denied and you want to appeal, then you might be thinking of hiring a lawyer. Although preparing, filing, documenting and appealing a claim for...

Aug 11, 2011 | Social Security SSD/SSI |

What is residual functional capacity? In Social Security parlance, the term “residual functional capacity” refers to the remaining abilities of someone who has a disability, after taking the disability into account. For example, imagine that you were paralyzed from...

Recent Comments